Create Perfect Cash Flow Template Excel Now

Introduction to Cash Flow Templates

Creating a perfect cash flow template in Excel is essential for businesses and individuals to manage their finances effectively. A well-designed template helps track income and expenses, ensuring that financial obligations are met on time. In this article, we will explore the key components of a cash flow template and provide a step-by-step guide on how to create one in Excel.

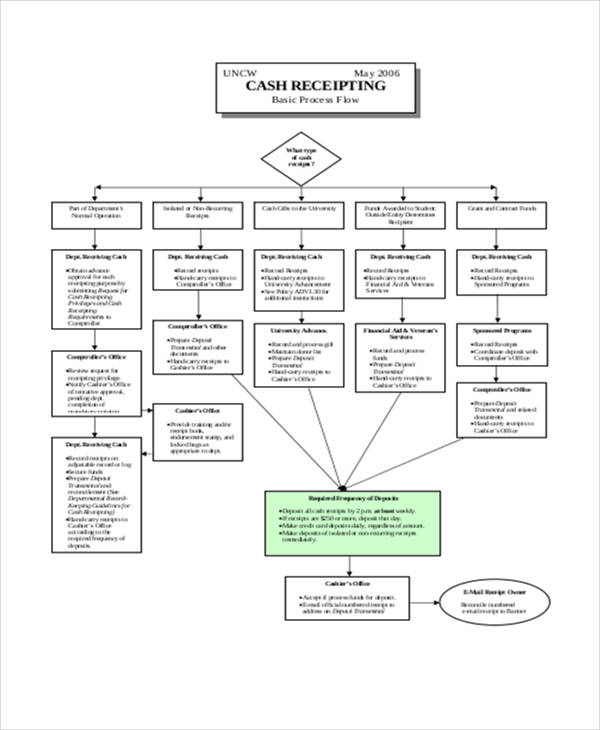

Understanding Cash Flow

Before diving into the template creation process, it’s crucial to understand the concept of cash flow. Cash flow refers to the movement of money into or out of a business or individual’s account. It’s the lifeblood of any financial entity, and managing it effectively is vital for success. There are three main types of cash flow: * Operating cash flow: generated from daily operations, such as sales and expenses. * Investing cash flow: related to investments, such as purchasing assets or selling investments. * Financing cash flow: related to borrowing or lending money, such as taking out a loan or issuing debt.

Components of a Cash Flow Template

A comprehensive cash flow template should include the following components: * Income section: lists all sources of income, such as sales, investments, and loans. * Fixed expenses section: lists regular expenses, such as rent, utilities, and salaries. * Variable expenses section: lists expenses that may vary from month to month, such as marketing and travel expenses. * Cash inflows section: tracks all incoming cash, including income and loans. * Cash outflows section: tracks all outgoing cash, including expenses and loan repayments. * Beginning and ending cash balances: shows the initial and final cash balances for each period.

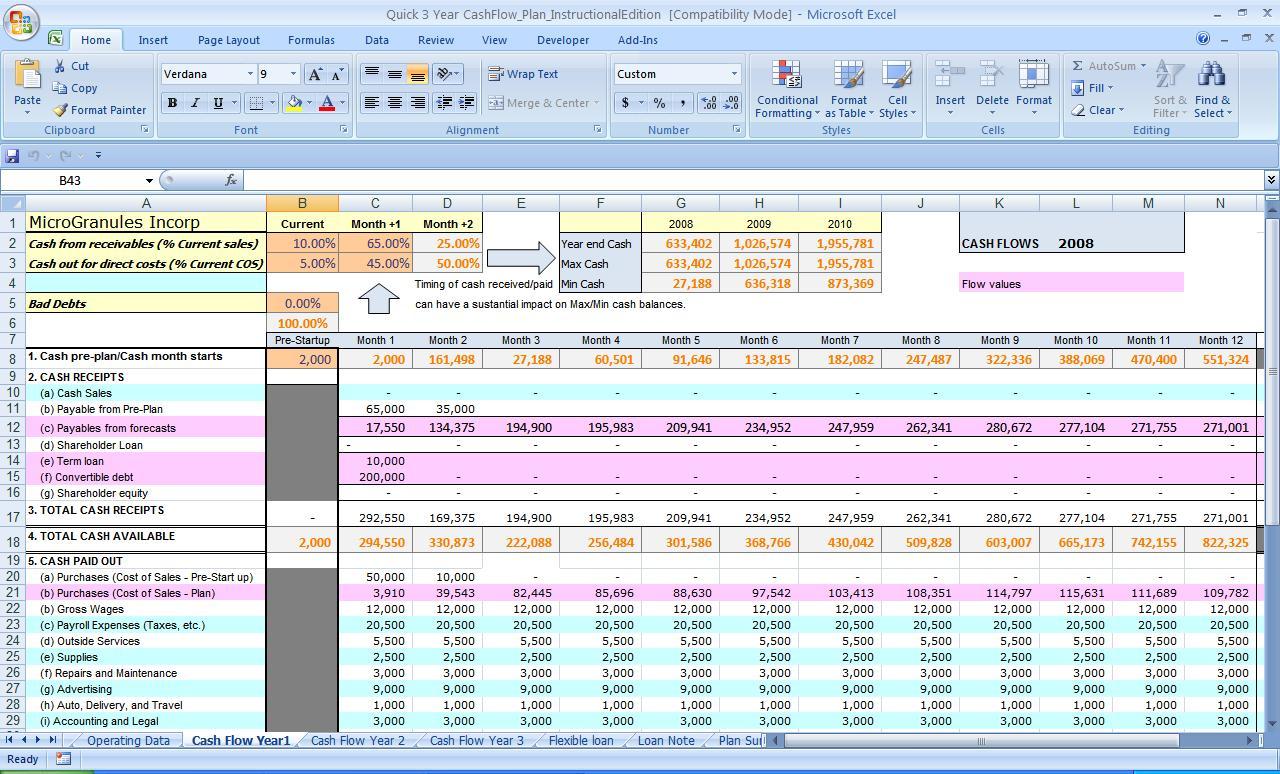

Creating a Cash Flow Template in Excel

To create a perfect cash flow template in Excel, follow these steps: * Open a new Excel spreadsheet and set up the following columns: + Date + Income + Fixed Expenses + Variable Expenses + Cash Inflows + Cash Outflows + Beginning Cash Balance + Ending Cash Balance * Enter the income and expense categories in the respective columns. * Use formulas to calculate the total income, total fixed expenses, and total variable expenses. * Use the SUM function to calculate the total cash inflows and outflows. * Use the IF function to determine the beginning and ending cash balances.

| Date | Income | Fixed Expenses | Variable Expenses | Cash Inflows | Cash Outflows | Beginning Cash Balance | Ending Cash Balance |

|---|---|---|---|---|---|---|---|

| 01/01/2023 | 1000 | 500 | 200 | 1200 | 700 | 1000 | 1500 |

Tips for Effective Cash Flow Management

To ensure effective cash flow management, follow these tips: * Regularly review and update the template: to ensure accuracy and catch any potential cash flow issues. * Prioritize expenses: focus on essential expenses, such as rent and utilities, and cut back on non-essential expenses. * Maintain an emergency fund: to cover unexpected expenses and avoid cash flow problems. * Monitor accounts receivable and payable: to ensure timely payments and avoid cash flow disruptions.

💡 Note: Regularly reviewing and updating the cash flow template is crucial to ensure accuracy and catch any potential cash flow issues.

In summary, creating a perfect cash flow template in Excel is essential for effective financial management. By including all the necessary components and following the steps outlined above, individuals and businesses can ensure a healthy cash flow and make informed financial decisions.

What is a cash flow template?

+

A cash flow template is a tool used to track and manage the inflow and outflow of cash in a business or individual’s account.

Why is cash flow management important?

+

Cash flow management is crucial to ensure that financial obligations are met on time, and it helps businesses and individuals make informed financial decisions.

How often should I review and update my cash flow template?

+

It’s recommended to review and update the cash flow template regularly, ideally on a monthly or quarterly basis, to ensure accuracy and catch any potential cash flow issues.